Manufacturer musical chairs, disgruntled Jag dealers and another canny Bramall investment?

The Car Dealer Weekly Briefing takes a look at the stories you need to know – and gives our editor in chief's views on them along the way

Welcome to this week’s Car Dealer Briefing – a new weekly digest from me, the editor-in-chief of Car Dealer Magazine.

Thank you to those of you who have already subscribed to continue receiving this update every Friday. It’ll be free to read for two more weeks (including this one) before moving to subscriber-only.

It is designed to give time-poor automotive leaders like you a recap of the week’s news with some of my thoughts along the way. Plus, I’ll be including some exclusives in it when I can find them.

If you’ve got any tips on what I should be covering – anonymous or not – please drop me a note on email, or you can find me easily on LinkedIn and send me a DM.

Subscribe using the button below to continue getting this briefing every week.

What’s happening?

This week, my conversations with car dealers have invariably led to what happens to the industry following the general election on July 4.

With even the Tories already seemingly admitting defeat in the face of numerous polls which show a near-wipe-out by Labour, car dealer bosses are preparing for life under Sir Keir Starmer. And most are worried…

‘They’re anti-capitalist and that means bad news for us,’ said one prominent car dealer this week when I called for a catch-up. ‘There’s no doubt taxes will go up and things like the living wage will impact our businesses.

‘But if they can come up with something to stimulate the economy and get people buying cars – especially EVs – then maybe the upsides will outweigh the down.’

Another had similar fears about what a Labour government with a ‘super-majority’ could mean for business, but they welcomed the party’s announcement that it would bring back the 2030 ICE ban.

‘While I don’t agree with a lot of their policies, the 2030 ban would make sense as most manufacturers are working towards that target despite the Tories changing it to 2035,’ said the dealer boss.

‘Our targets and the ZEV mandate are focused towards 2030 – however impossible those targets may be – so reminding consumers of the deadline with the ban and all the publicity that will entail is no bad thing in my mind.’

The Top 5 Need-To-Knows

1. Tony Bramall splashes out

The octogenarian veteran car dealer has invested in car subscription start-up Drive Fuze. The firm is run by former Ford of Europe car finance chief Nick Rothwell and has former Lookers CEO Peter Jones on its board.

It offers cars for a monthly payment that includes comprehensive insurance, servicing and vehicle tax as well as breakdown cover, and allows drivers to cover 1,000 miles a month. Bramall says he is ‘convinced’ the investment was the right choice.

Bramall sold his 20% shareholding in Lookers to Constellation Automotive Group in 2022 for £80m and had previously sold his car dealer business to Pendragon in 2004 for £240m. He told This Is Money he hasn’t given up investing just yet… despite being nearly 90.

What do I think?

Would you bet against a multi-millionaire? I certainly wouldn’t and I suspect Tony Bramall isn’t someone who splashes his cash lightly. However, recent history has not been kind to car subscription services. Cazoo's purchase of Drover went south pretty quickly and Onto filed for administration.

So what’s the problem with car subscriptions? Well, in the past they have just looked a little too expensive. Saying that, some of the cars on the Drive Fuze website look good value – especially when you consider they include car insurance, vehicle tax and servicing – like the Citroen C1 for £379 a month. Having all that taken care of for you does seem pretty attractive, but others on the site look painfully pricey. An Audi e-tron for £2k a month? No thanks.

In a world of time-poor individuals, you’d think car subscriptions would be very attractive, but no one has yet managed to really crack it. Maybe Bramall has spotted one that finally will. It will also be helped by car manufacturers desperate to find an outlet for stock they can’t sell, meaning large fleet deals – especially on EVs – could lead to some better-priced monthly payments for firms like this.

2. Bill Berman set for another bumper pay deal

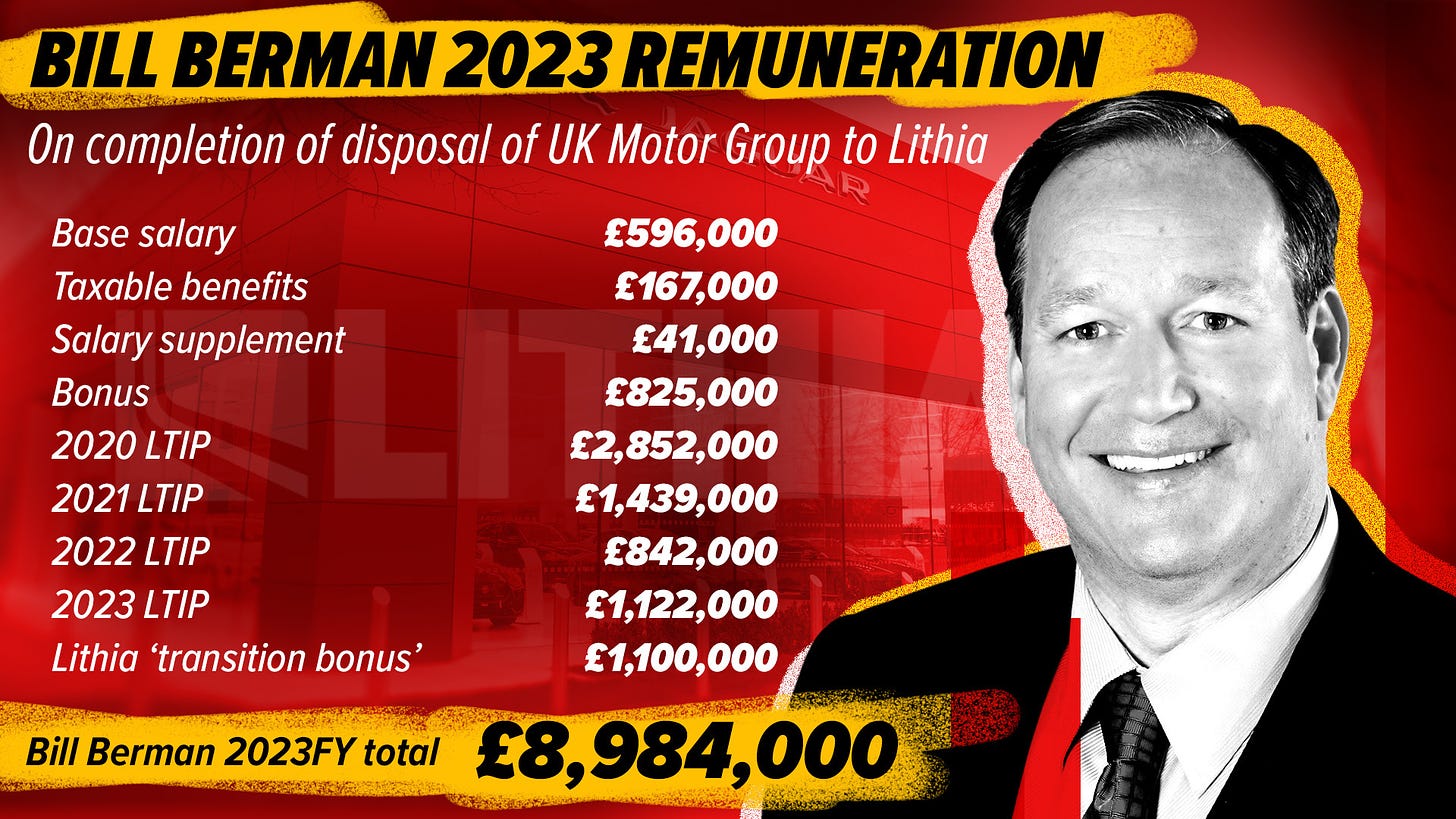

Shareholders will be asked to vote on another huge pay deal for former Pendragon boss and now Pinewood CEO Bill Berman next week. The American was paid a staggering £8.9m last year after the Lithia deal to buy Pendragon’s dealerships went through. That included a £1.1m ‘transition bonus’ paid out after the contracts were signed. Now he’s set to get another huge chunk of change if shareholders ratify his latest package.

On Wednesday, at a general meeting, investors will be asked to approve a deal that could see him paid as much as £7.8m at a share price of 371p, or £8.3m at a share price of 556p in three years. It includes a salary of £575,000, benefits and supplements worth around £190,000 and a bonus of £862,500. But it’s the LTIP and DSP share packages that have rattled shareholders. One told me that they think it’ll get through as ‘the dust is still in people’s eyes’ over the Lithia deal.

What do I think?

I was tipped off about this story by an aggrieved shareholder who wasn’t particularly happy that boss Berman is in line for yet another massive pay deal. The huge sums Berman received when he was in charge of Pendragon never went down well, with his last pay deal only being backed by 79.1% of shareholders. The way this new deal has been stacked is overly complicated and incredibly hard to unpick.

The figures are pretty staggering and the row boils down to the fact they were calculated using the company’s estimated valuation, which was a share price of 206p. The actual share price now is far higher – at 385p – meaning the share awards are worth far more.

It’s unlikely the shareholders will vote against it at next week’s general meeting, but don’t be surprised if Berman gets another bloodied nose. The other question remains around why this is being dealt with at a general meeting and wasn’t sorted at the AGM, as is usually the case. I asked the company the question but didn’t get a response…

3. Jaguar dealers threaten legal action

Jaguar dealers in Canada are threatening legal action over its move to a lower-volume, electric future. One dealer is claiming nearly $7m in damages over the brand’s decision to ditch its higher-selling SUVs and saloons – which in Canada sold around 8,000 units a year – to be replaced by one electric car that might clock up 700 sales annually.

Talks are said to be ongoing between the brand and its dealer partners, but the franchisees have reserved the right to take the matter to court. Jaguar is set to launch its new electric car in 2025, but many dealers made huge investments on the promise of two high volume-brands. They’re not convinced the new electric-only future for Jaguar will work.

What do I think?

JLR has been preparing Jaguar for EVs only for a while, but the move has cheesed off its partners across the world. That’s because when many invested tens of millions of pounds into fancy Dual Arch showrooms to house both its Jaguar and Land Rover franchises, there was the promise of high volumes.

This was at a time when Jaguar was rolling out reasonably popular SUVs like the F and E-Pace, had the F-Type sports cars, plus saloons like the XJ, XF and XE. With a model range like that, dealers were selling higher volumes, and while they never made the same money they did on Land Rovers, Jaguars had a steady and loyal customer base.

The future looks very different. The new electric Jag will be ultra high end and expensive – and does anyone really need an expensive EV right now? No wonder many of the dealers are a little peeved. In the UK, dealer numbers have been slashed, but it's interesting to see the Canadians say they’ll take the battle to court. I doubt the same would happen here – those that kept the Land Rover franchise are happy, while most of those that lost out have already moved on to court Chinese newcomers instead.

4. Manufacturer musical chairs

There were big announcements in the car manufacturer leadership world this week with three major changes. The most prominent of all was news that Andrew Doyle, Audi UK’s Australian boss, is heading back to his homeland to run listed dealer group Peter Warren Automotive. He leaves in September for the £365k-a-year job with no news of his replacement.

Polestar waves goodbye to industry stalwart Jonathan Goodman after a 38-year motor trade career. He’ll be retiring at the end of June to be replaced by Nio UK’s boss Matt Galvin, who has joined the brand. There’s no news from Nio as to who’ll replace him, though.

What do I think?

My biggest question on all this is where does it leave the new electric car brand Nio? This is the firm that builds Power Swap Stations, where its car owners can have depleted batteries swapped over on their journey for a fully charged one in minutes. It was due to launch here this year, but that plan has been put on ice and rumours are it is struggling to get permission to build its battery-swapping sites. With Galvin gone, what happens next?

I asked the company about its plans and its response is included in this week’s briefing exclusively for subscribers.

A spokesperson told me: ‘Nio is here to stay and remains committed to Europe and its expansion within the market.

‘In the UK, Nio is continuing its preparations for entry into the market, with the date and models yet to be confirmed.

‘We thank Matt Galvin for his support as managing director within the market and as head of European sales across the wider team, and wish him luck in his new role. We will share more information on the UK date and models when available.

‘Nio remains committed to supporting users across Europe now and in the future.’

The electric car maker quietly made a round of redundancies at the turn of the year, which a spokesperson called ‘streamlining’ but says it still has an engineering base in Oxford.

Oh, and on Doyle’s appointment to run a car dealer group in Australia? I’ll leave my comment to one of his dealers who called me after we ran the story: ‘Running a car dealer group is absolutely nothing like running a car company – good luck to him.’

5. Fisker files for bankruptcy

Troubled EV maker Fisker has filed for bankruptcy protection in the US. The firm has burnt through cash trying to ramp up production of its Ocean SUV and is said to have even tried to get help from car maker Nissan.

It wanted the Japanese firm to plough in some cash, but a deal never materialised, which in turn led to another investor refusing to put in a promised £275m that was dependent on Nissan’s partnership. Fisker is now trying to save what it can by selling assets and restructuring its debt.

Fisker launched in 2016 and merged with a blank-cheque firm in 2020 in a flotation that saw it valued at $2.9bn (circa £2.28bn). It has been selling the Fisker Ocean here in the UK.

What do I think?

A few weeks ago I spotted a glut of Fisker Oceans appearing on auction website Carwow. They came up locally, as I always keep an eye out for nearby cars, and there were two for sale just five miles away from me with less than 2,000 miles on them. They didn’t find buyers.

I couldn’t work out why owners were trying to ditch their new cars so early – and that’s when I spotted the rumours. A simple web search revealed the trouble Fisker was in. Owners were clearly worried about the servicing and support they’d get and were trying to get out of them while they could. If it was hard then, it’ll be near impossible now.

I spoke to Estelle Miller from EV Experts this week after the news of the bankruptcy broke. Her firm is representing the brand in the south of England for sales.

She said Fisker UK is a separate legal entity to Fisker US and so far there is no update on what it means here.

Miller exclusively told the Car Dealer Briefing: ‘Fisker referred us to their statement about the Chapter 11 and said there is nothing to update for Fisker UK right now.

‘We can still offer test drives and inventory is available on the Fisker UK website. The Fisker UK team are still at their desks, or out helping their customers.’

Quote of the week

‘Our research shows how dealers are the go-to option for finance for most car buyers, although the level of discomfort many feel should be factored in by all retailers.’

Motors marketing director Lucy Tugby, on its research which showed that three-quarters of car buyers will consider finance offered by car dealers – but only half admit they’re comfortable with the process. Read the story here.

What I’ve heard

There’s a growing popularity with a number of savvy car dealers I’ve been chatting to for stocking used EVs. A few now have said they’re starting to enjoy some success with used EVs as customers like the option when they’re priced right.

Swansway’s Peter Smyth recently told us that if it ‘starts with a two’, customers are keen to consider a used EV. Many others I’m chatting to are now saying similar things and suggest that when used electric cars are priced with parity to a similar petrol or diesel car, customers are willing to give them a go.

The statistics don’t always say the same, though. Whenever I check the retail rating on Auto Trader of a used electric car, the projected days to sell and overall rating usually put me off buying one. Perhaps it’s time to give them a go, though, with many other dealers starting to make them work – and making healthy profits as a result.

Car Dealer Podcast:

Steve Hurn, SH Specialist Cars

In this week’s Car Dealer Podcast, Jon and I chat to Steve Hurn – a specialist car dealer who sells some seriously high-end models. He tells us about how he’s found buyers recently for a LaFerrari Aperta and a £2.8m Mercedes Project 1.

He also gives his frank opinion on auction websites Motorway and Carwow, as well as why he won’t be buying any electric cars any time soon (in stark contrast to those dealers above).

‘I just wouldn't buy one – I would be too scared about being stuck with one,’ he told the show. ‘We're at the end of the VHS/Betamax argument of vehicles and I think that that's what electric vehicles are for people.’

You can listen to the full episode later today (Friday) on Spotify, Apple Podcasts or whatever platform you prefer. Just search for the ‘Car Dealer Podcast’.

And the pick of the rest of the week’s headlines that caught my eye

Used car dealer sold ‘unroadworthy’ Mondeo

A used car dealer must shell out £22k after a court found a Ford Mondeo it sold was so badly riddled with corrosion the rear suspension could have collapsed. Ali Mohammed, who is the director of Dynamic Car Sales in Sedgley Road, Dudley, admitted selling the ‘dangerous and unroadworthy’ car last July when he appeared before town magistrates on June 14. Mohammed was fined £10,000 and Dynamic Car Sales was fined £2,500, together with a victim surcharge of £2,000. The court also awarded the customer full compensation of £2,576 and awarded the council full costs of £5,069, making a total of £22,145 that Mohammed and his used car business must fork out. In addition, the car must be scrapped.

Volvo brings back the boot

Volvo has U-turned on its decision to halt the sale of its iconic estate cars in the UK, according to reports. The V60 and V90 will be reintroduced imminently to the UK due to a ‘resurgence in interest’ in estate cars. ‘We will begin taking orders next month,’ a spokesperson told Autocar.

US cracks down further on foreign tech

The US has come down harder on Chinese-made tech, which the country believes is a threat to national security. The Biden administration has already announced an investigation into the threat Chinese cars might pose, and now the House of Representatives has passed a ban on the future sale of DJI drones in the US. Chinese-made EVs face 100% tariffs in the US.

Caterham committed

Sports car maker Caterham said its home is firmly rooted in the UK, despite being owned by Japan-based VT Holdings. Boss Bob Laishley spoke exclusively to Car Dealer this week as it opened a new facility in Dartford just down the road from its old base. Currently, the brand has a waiting list that stretches 14 months and needs to ramp up production to avoid losing customers. ‘The additional capacity allows us to fulfil this,’ said Laishley.

BYD bounce from Euros

If you hadn’t noticed, there’s lots of football on the telly and with it some prominent branding for Chinese car maker BYD. Auto Trader said there were 26k views of BYD models on its platform during the first weekend of the Euros – a 69% increase on the previous week and a direct result of the promotion at the Euros. More than 10m people are said to have watched England win, and Auto Trader’s Erin Baker said the marketing around the game was ‘triggering a step change in awareness’ for BYD.

Mike Hawes handed OBE

SMMT chief executive Mike Hawes was awarded an OBE in this year’s King’s Birthday Honours. He has been made an Officer of the Order of the British Empire for services to the automotive industry. Hawes said: ‘Receiving such an award for services to the industry I love and have spent so much of my life championing is a huge honour.’

If you want to keep up to date with the very latest breaking news from CarDealerMagazine.co.uk you can join our popular WhatsApp groups. The link to the latest one is here.

And don’t forget you can hear us chat about the biggest Car Dealer headlines with an industry guest every week on our Podcast. Search for the ‘Car Dealer Podcast’ wherever you get your shows.

The Car Dealer Weekly Briefing will be free for the next two weeks only (including this one), so make sure you subscribe to keep getting the reader’s digest every Friday afternoon. Hit the button below to find out how.

See you next week,

James